It started in sheer madness on March 13 when the Donald was persuaded to declare a national emergency by his camarilla of dopey doctors.

Their stay-at-home guidelines were absolute folly because by then it was obvious that the new Wuhan virus strain mainly attacked the aged, infirm and those already afflicted with serious cardiovascular, respiratory, renal and diabetes/obesity ailments, not the general population. For more than 90% of the population what was happening in mid- March was merely the cresting of a bad winter flu pandemic.

So the obvious thing to do was to protect the small segment of people—especially nursing and retirement home residents—who are vulnerable to serious illness or death from the Covid and allow business as usual to be carried on by the vast bulk of the population.

After all, that’s what successfully happened during the Hong Kong flu pandemic of 1968- 1969. Back then the mortality rate was computed by the CDC at 68 per 100,000 or nearly 3X higher than the WITH Covid death count to date (85,000 deaths or a 25 per 100,000 mortality rate), but lockdowns and stay-at-home orders were not even on the radar screen.

By setting aside common sense, economic sanity and the constitution itself, however, the Donald’s emergency declaration and CDC guidelines triggered a veritable pandemic of public hysteria and governmental madness. Within days governors and mayors around the country were literally imitating the infamous civil war “surgeons” who amputated any limb that was or might become infected—-in this case, the economic and social arms and legs of most of their citizenry.

There is no doubt that New York governor Andrew Cuomo was the lead bone-saw wielder among this rabid pack of economic surgeons. The tip-off was there from day # 1 when he justified shutting down his state’s economy and confining almost 20 million people to house arrest two months ago by saying,

If everything we do saves just one life, I’ll be happy.

Oh, puleese!

Whenever—short of the Bubonic Plague, a foreign military invasion or the arrival of little green men from Mars—the government gets in the death prevention business you might as well kiss liberty and capitalist prosperity good-bye.

That’s because upwards of 2.9 million American die every year, and for every major cause of death there is an endless supply of so-called experts, think tanks, lobbies, ambitious politicians and do-gooders with schemes to “save lives”.

A mere listing of the annual causes of death tells you that inviting the government in to help “save lives” from the ordinary risks of human existence would result in a Gong Show of coercive, costly and contradictory interventions. During 2018, for instance, the major causes of death included,

- 655,000 from heart diseases;

- 600,000 from cancer;

- 167,000 from auto and other accidents;

- 160,000 from respiratory illnesses;

- 148,000 from strokes,

- 122,000 for Alzheimer,

- 85,000 from diabetes;

- 60,000 from influenza and pneumonia;

- 51,000 from renal diseases;

- 48,000 from suicide; and

- 144,000 from all other causes. So, yes, if you want a Nanny State, you could empower Health Patrols everywhere to police eating, smoking, drinking, exercising, driving, sky-diving, swimming, sunning, boating, emoting, farming, food processing, and countless more “risky” activities—the suppression of which could arguably “save lives”.

Needless to say, we do not exaggerate—not when you consider the insane orders that were issued on hardly a moments notice to “save lives” allegedly threatened by the Covid. They are a vivid reminder that unless there is an overpowering and existential threat to society’s very survival, there is no reason to turn officialdom and their bone- saw surgeons loose on the economy in the name of public health protection and “saving lives”.

For instance, James Bovard noted that in state after state, the quarantine orders were literally over-the-top in their level of specificity and intrusion:

“We have saved lives” is also the self-exoneration trumpeted by Michigan governor Gretchen Whitmer after she imposed the most punitive restrictions in the nation. Whitmer prohibited “all public and private gatherings of any size” (prohibiting people from visiting friends) and also prohibited purchasing seeds for spring planting in stores after she decreed that a “nonessential” activity. (Purchasing state lottery tickets was still an “essential” activity, though.)

Many Michigan counties have less than a handful of COVID cases and have had few if any fatalities. But their economies have been obliterated by Whitmer’s statewide decrees, which have driven unemployment up to 24 percent.

Unfortunately, the hysteria did not end with the Lockdown orders. The resulting instantaneous and absolute collapse of business activity—-especially in the social congregation sectors like restaurants, bars, malls, hotels, gyms, movies etc.—led to deafening cries for a coast-to–coast soup line of bailouts.

The resulting fiscal eruption is truly one for the ages. On the eve of the Donald’s ill-fated national emergency declaration on March 13, the public debt stood at $23.4 trillion. But exactly 64 days later after a flurry of bailout legislation that nobody read, it stands at $25.3 trillion. That is, the US Treasury has borrowed an average of $29 billion per day including weekends and Easter.

Ordinarily, of course, a $1.9 trillion drain on the bond pits in barely 9 weeks would have caused immense wailing and gnashing of teeth among private borrowers, who would be crowded out by the Treasury’s sharp elbows (i.e. a willingness to pay whatever it takes in yield to get the cash) and soaring interest rates.

But not in this day and age. As we have frequently said, every historical notion of monetary policy limits and financial discipline has been euthanized by the Keynesian money printers at the Fed.

And print they have. At the last posting before the disaster of Lockdown Nation commenced on March 13, the Fed’s balance sheet stood at $4.31 trillion, and has since soared to $6.93 trillion as of May 13, representing a $2.6 trillion or 60% expansion in less than nine weeks.

Holy cow!

These madmen have monetized every single dime of the Treasury’s $1.9 trillion debt issuance, thereby flooding the bond pits with an off-setting supply of freshly minted digital cash. And then they tossed in another $700 billion for good measure, or to “support” the economy, whatever that means.

Here’s the thing. The public and private sectors of the US economy are already buckling under $75 trillion of debt. So they idea that enabling both politicians and businesses to borrow even more trillions at virtually zero interest rates is a strange way to “support” anything that is rational, economically sensible or even remotely sustainable.

But what this money printing madness is doing is causing nearly all economic actors to take leave of their senses—and we mean most especially the politicians throughout the land. The latter apparently think we have a Rich Uncle Sam, who can be tapped to fund the coast-to-coast soup lines that were stood up by the $3 trillion Everything Bailouts last month.

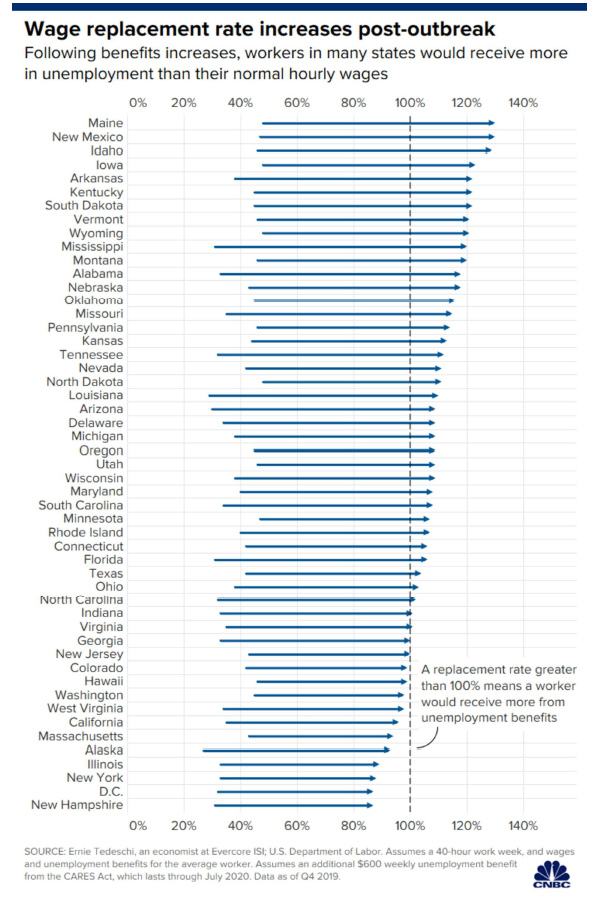

Among the endless fiscal follies embedded in these bills was a $600 per week add-on to the unemployment checks of what are now more than 22 million recipients, but heading toward 35 million as the state labor department scramble to catch-up with the tsunami of initial claims applications in the last eight weeks.

The problem is that when added to the average state benefit of $400 per week, you have suddenly put tens of millions of workers in a position were they are better off staying home than going back to work.

That’s because at an average combined Federal state benefit of $1,000 per week, you have 71 million workers in America who earned less than that in the most recent year for which we have detailed payroll statistics (2018).

That’s right. Our panicked legislators seem to have no clue that the overwhelming share of new jobs reported since the Great Recession ended in 2009 were essentially part-time and low pay service industry jobs, where the average paycheck is well less than $500 per week, to say nothing of the $1,000 per week level embodied in the Everything Bailouts.

For instance, on the eve of the Covid Hysteria in February, there were nearly 17 million payroll jobs in the leisure and hospitality sector, but these workers averaged only 24.7 hours per week on the clock at an average hourly rate of $14.90 per hour.

That computes to weekly paycheck of $368 before withholding taxes and other deductions.

Not surprisingly, therefore, a new analysis by three economists at the University of Chicago based on government data from 2019 estimates that 68 percent of unemployed workers who can receive benefits are eligible for payments that are greater than their lost earnings.

Indeed, it found that the estimated median replacement rate — the share of a worker’s original weekly salary that is being replaced by unemployment benefits — is 134 percent, or more than one-third above their original wage.

Is it any wonder, therefore, that employers trying to re-opening their businesses everywhere across the nation are now confronting a strange new reluctance among their employees to come back to work?

Recently, the WSJ investigated this topic and found, for example, that until April 18 Disney kept paying its 100,000 employees in its theme parks, but then furloughed all of them without pay thereafter.

What happened next tells you all you need to know about why the so-called “re-opening” of the economy is going to resemble a giant Gong Show as between workers preferring their $1,000 per week on UI, on the one hand, and state and local bureaucrats explaining you can open your restaurant, for instance, as long as you remove 75% of the tables and thereby insure your own immediate bankruptcy, on the other.

In any event, what Disney now has is a workforce which is immensely grateful for its kindness in pulling the plug on their paychecks!

One Disney World employee, who has worked at the park for several years, makes a little more than $14 an hour as part of the entertainment team. At 40 hours a week, he takes home about $400 after taxes.

His unemployment claim has still not been processed in Florida since he was furloughed, but he expects his weekly income to more than double when it is. Unemployment benefits will likely come in at $275, plus the extra $600 added by the government’s plan through July 31.

“We are grateful Disney has chosen to furlough us,” the entertainer said.

Needless to say, this ain’t just Disney. As shown so dramatically in the table below, the average worker in all but a handful of states is now grateful, like his/her Disney counterpart, to have gotten a furlough notice. too:

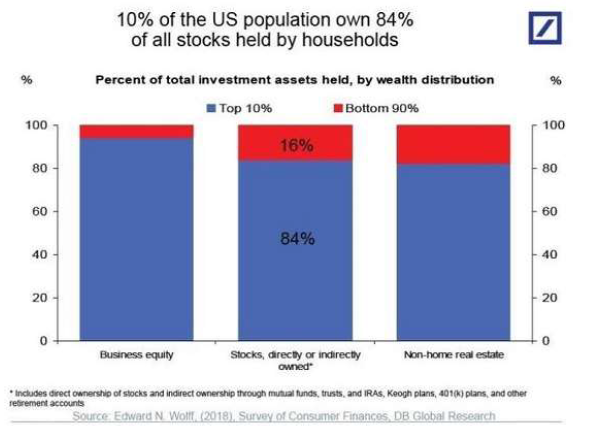

At the same time, the stock market is now less than 5% from its insane February 19th all-time high (NASDAQ 100) owing to the Fed’s madcap money printing. So the top 10% of households who actually make more than $50,000 per year are tickled pink, as well.

Here’s the thing, of course. The civil war surgeons ended up killing or maiming far more than they saved.

And that’s exactly the outcome that can be expected from the Donald’s malpracting doctors, as well.

This article was originally published at Contra Corner.