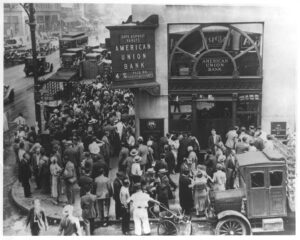

One of the most fascinating phenomena in financial crises is that of bank runs. That’s when panicked depositors rush to their bank to withdraw their money because they’re convinced that the bank is going broke. Everyone tries to withdraw his money before that happens. If the bank does finally go under, the people who failed to withdraw their money are left with a bank that has no money to return to them.

That’s what the FDIC is all about. It insures everyone’s deposits up to a limit of $250,000. The limit used to be $100,000 but U.S. officials, for whatever reason, wanted to make depositors feel even more secure about keeping their money in the bank.

The idea is that people don’t have to worry about losing their money if their bank goes under because the federal government will use taxpayer money to reimburse them. Thus, knowing that their money is “insured” by the government, people have less incentive to rush to the bank to withdraw their money in the event of a potential bank failure.

Of course, one problem with the FDIC insurance is that it enables weaker banks to continue operating, which could make the problem much worse in the future. Without the FDIC, weak banks would go under sooner because people, sensing a problem, would rush to withdraw their money.

Sure, without an FDIC, that would mean that depositors would lose their money. But why should picking the wrong bank be any different from picking the wrong stock or any other investment? We don’t have a Federal Stock Insurance Corporation. If people invest in a stock and the company goes bankrupt, then people lose their money. That encourages people to take care about where they invest their money.

That same degree of care doesn’t exist when it comes to banking. Very few people study the financial condition of the bank in which they deposit their money. That’s because of the FDIC. They know that if the bank goes under, they’re going to get reimbursed by the taxpayers.

But what happens if there is a nationwide banking collapse? The amount of money in the FDIC’s insurance fund is enough to cover losses in several individual banks. But it doesn’t even come close to being able to do that in the event of an industrywide banking collapse.

But what happens if there is a nationwide banking collapse? The amount of money in the FDIC’s insurance fund is enough to cover losses in several individual banks. But it doesn’t even come close to being able to do that in the event of an industrywide banking collapse.

If that were to happen, then the bank-run phenomenon would surface because panicked depositors would be rushing to get their money out of banks, knowing that there would inevitably be depositors who would be caught holding the bag.

A healthy bank system would be one in which weaker banks are permitted to go under, even if they take their depositors with them. The fact that weaker banks have been permitted to continue operating, thanks to the FDIC, and the fact that weaker banks are periodically permitted to be absorbed by stronger banks, does not augur well for the overall strength of the banking system.

What would happen if there was an industrywide banking crisis? We can examine what happened in Argentina in the early 2000s to give us a clue as to what might happen here.

The Argentine government lacked the money to cover everyone’s bank deposits. People began panicking and rushing to the banks to withdraw their money. Fearing a devaluation, many of the depositors began converting their Argentina peso accounts into U.S. dollars and then transferring their money to foreign accounts. The entire banking system was under siege.

The government’s response? It froze all bank accounts, effectively prohibiting people from withdrawing their money from the banks. In other words, people were forbidden from accessing their own money, with one exception: People were permitted to withdraw a very small amount — 250 pesos, later 300— to cover weekly expenses. No one was permitted to withdraw dollar accounts, unless he first converted them into pesos.

Of course, U.S. officials say that an industry-wide banking crisis could never happen in the United States because the U.S. is such a powerful empire. Let’s hope they are right. And let’s just continue acting as though decades of a destructive banking policy, skyrocketing federal spending, spiraling federal debt (now in excess of $31 trillion), and monetary debauchery will come with no adverse consequences.