Amidst all the glee over Congress’s $2 trillion “stimulus” package, an important and relevant question naturally arises: Will the federal government end up nationalizing and confiscating people’s retirement accounts to pay for the ever-burgeoning expenses of the welfare-warfare state way of life?

Prior to the coronavirus crisis, the federal government was spending $1 trillion more than what it was bringing in tax revenue. That meant that the feds were set to add on another $1 trillion in debt to the federal government’s $23 trillion in debt. That would make the federal government’s total debt $24 trillion.

Then suddenly the coronavirus hit and businesses began shutting down, in part because governments at all levels have been ordering them to.

These shut-down businesses are now laying off workers, millions of workers.

Shut-down businesses and unemployed workers mean a lot less income tax revenue for the federal government.

Yet, at the same time, the federal government, unlike the private sector, is maintaining its current level of expenditures. That’s because everyone on the dole, including the military, seniors, and big corporations are absolutely insistent that their dole and bailout money continue during the crisis.

So, what has the federal government done in response to the coronavirus crisis?

To the great glee and celebration of the mainstream press, it has decreed a $2 trillion “stimulus” package, which entails having the federal government send small checks to individuals and extremely large checks to big corporations and businesses.

The “stimulus” money

Of course, hardly anyone is asking the obvious question: Given that the federal government was already spending $1 trillion more than what it was bringing in, how in the world is it now spending another $2 trillion?

Did the federal government has this stash of cash under its bed, ready to be used on a rainy day? Or is the federal government a magician that can convert stones into paper money?

Where is our political daddy getting that additional $2 trillion that is supposedly going to “stimulate” the economy.

The answer is: The government is borrowing the money and printing the money.

In other words, the amount of the federal debt is set to now go to $26 trillion or the government is simply going to print the money, or a combination of both.

To the extent that the government prints the money, people will end up paying an inflation tax down the road, which will be reflected by devaluation or debasement of the value of their money. That will be reflected by rising prices in the economy.

Spending, debt, and confiscation

It is worth recalling why Congress has set a debt ceiling, even though it continues raising it every time it is reached. It’s because even Congress understands that too much debt is a bad thing, a dangerous thing for a government to incur.

Just ask the Greeks. The government in that country incurred so much debt that its tax revenues were ultimately insufficient to pay the interest on the debt and the costs of its welfare programs.

What happens if the U.S. government reaches that point — the point where its tax revenues are insufficient to pay for the interest owing on its massive, ever-growing debt and its massive welfare-warfare payments, including payments to Social Security, Medicare, and military dole recipients?

Theoretically, it could simply default on some of these payments. But how likely is that?

The more likely course of action is for the feds to look for ways to get their hands on more money. What would be the easiest and quickest way for the federal government to get its hands on a large amount of cash to pay its bills?

It could nationalize and confiscate everyone’s 401(k)s. That’s what the Argentine government did in the 2008 economic crisis. It seized everyone’s private pensions — $30 billion. It’s also what the Franklin Roosevelt administration did in the 1930s with gold coins, which had been the official constitutional money for the American people for more than 100 years.

Could the owners of 401(k)s sue? They could but they wouldn’t get anywhere because in times of crisis, the federal courts go silent, as we saw after the 9/11 crisis. And don’t forget that the Supreme Court upheld FDR’s nationalization and confiscation of people’s gold coins in the 1930s economic crisis, even though the Constitution established a gold-coin monetary system.

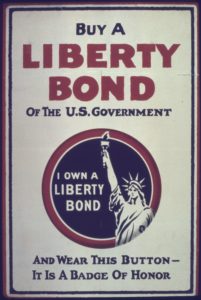

Of course, if U.S. officials do go down this road, they will give people long-term government bonds in exchange for their cash. People will discover, however, that those bonds are nothing more than guaranteed instruments of confiscation, as the Federal Reserve engages in a massive paper-money inflationary campaign that will devalue all those government bonds.

The worst mistake America ever made was converting the federal government into a welfare-warfare state. Hopefully, they will not have to pay that price in terms of a federal takeover of their retirement accounts. But in the midst of a crisis, government officials are capable of anything.